What did we wager? That initial contact with the client is when the retention starts to build.

Clients do not usually give their insurance plan much thought — they only think about it when buying a policy and when filing a claim.

For the “lucky” ones, the only time they’ll be in contact with an insurance provider is the day they sign on to the policy. It is therefore crucial for this first contact to be meticulously thought-out to ensure a smooth, coherent, and satisfying customer experience, regardless of the method used to take out a policy (at a branch office, via the website or app, or by phone — yes, some people still buy insurance over the phone).

Using an inverted approach.

Identifying key moments

of the customer experience.

We embarked on an extensive field study to put ourselves in the shoes of new clients looking for insurance. This allowed us to simulate the experience of each customer type on the basis of their profile. Modeling their journey raised several key moments when it is possible to better listen to clients and communicate with them.

Working in close cooperation with the staff at GMF, we were able to develop a new welcome sequence. Our guiding principle was to design a personalized, engaging experience, tailored to each customer type.

The timing and content of the welcome sequence were completely revised, along with the various interactions on physical and digital channels.

Going from a welcome sequence guided by processes to one that is client-focused.

The original welcome sequence for new clients had been developed with operational and efficiency goals in mind. It was in keeping with older processes which, although efficient from a technical point of view, didn’t account for the client’s real-life experience.

Our goal was therefore to challenge this process and shift the focus onto the client experience.

We achieved this by applying a number of changes at every level of the welcome sequence. It was redesigned to be shorter, going from a few months to a few days, to capitalize on the key moment of the policy purchase. That specific window is when the client is most open to communication and to being in contact with their insurance provider. Originally, new clients would receive their membership card in the mail a few months after buying their policy. Now, the card is created when the client is at the branch office, and they walk away with everything they need the same day. This seemingly simple change required technical processes to be transformed, agents to be trained in the field, print material to be adapted, etc. In this way, we transformed many different details and the process of the welcome sequence to make it more consistent and tailored to the client’s needs.

A shorter, richer process translates into clients who are more engaged with their insurance.

No more unintelligible contracts with endless clauses!

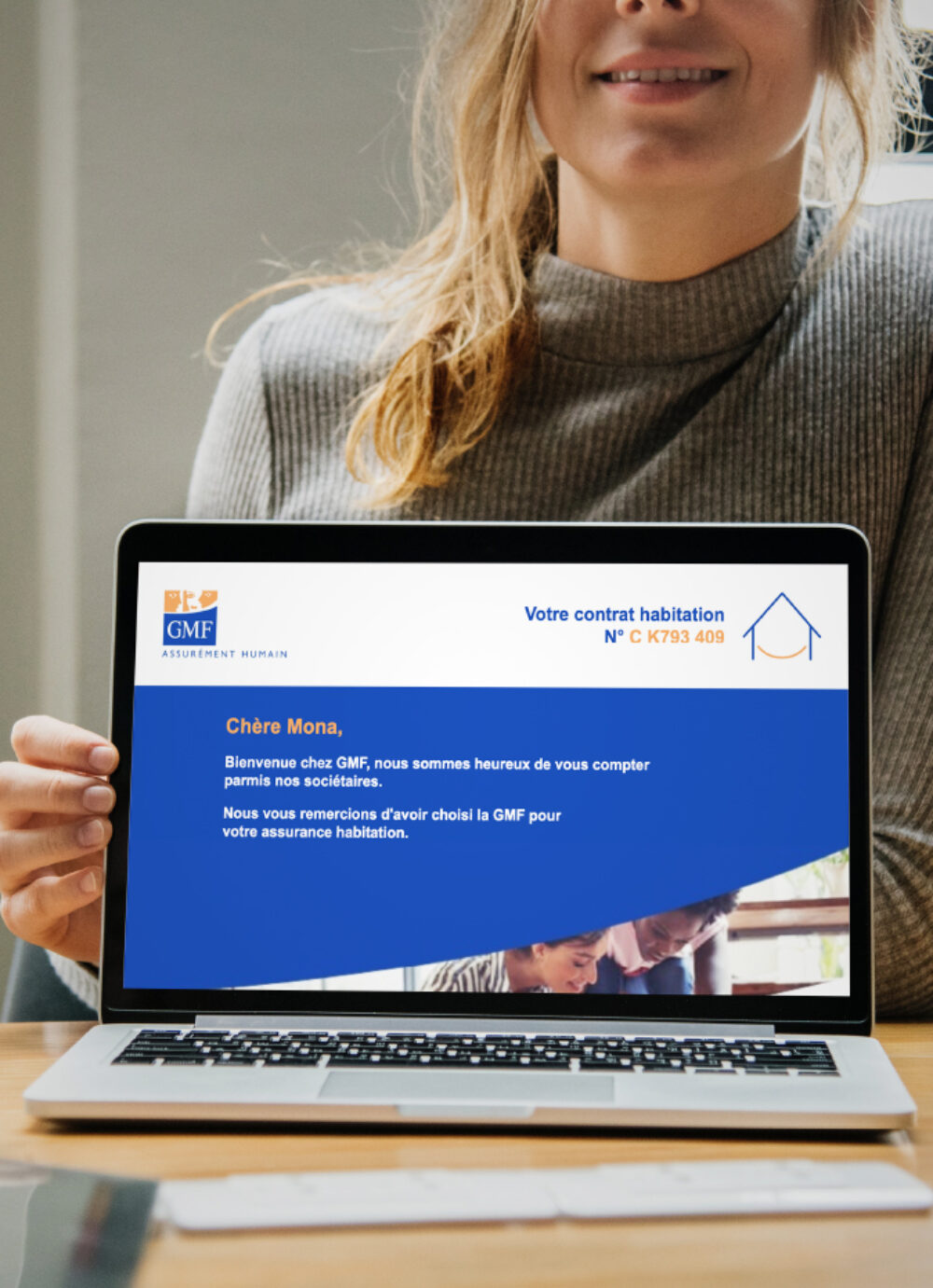

To improve the customer experience in insurance, those lengthy contracts — written by and for legal experts — need to be simplified. This is exactly what we did for GMF’s future clients! We combed through all the fine print and the hidden clauses to create a more readable, clearer version. GMF’s new clients can now quickly understand the key points of their policy, and still have the option to read the standard contract (if they are inclined to do so). This information was included in a brand-new welcome kit that is equal parts useful and enjoyable. This kit allows each policyholder to understand their new contract and its guarantees, while also offering useful advice if a problem arises.

Understanding clients to offer a customized.

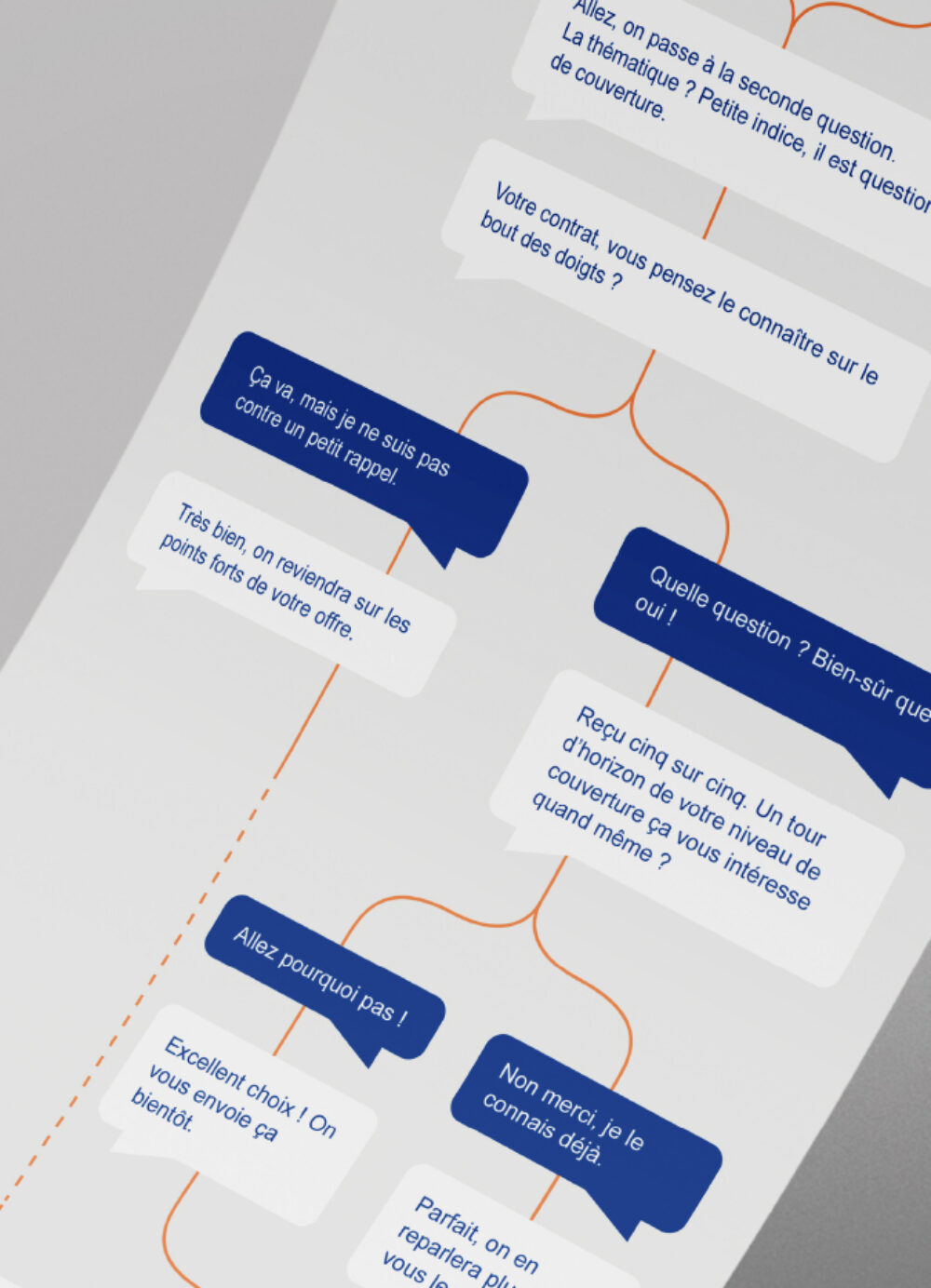

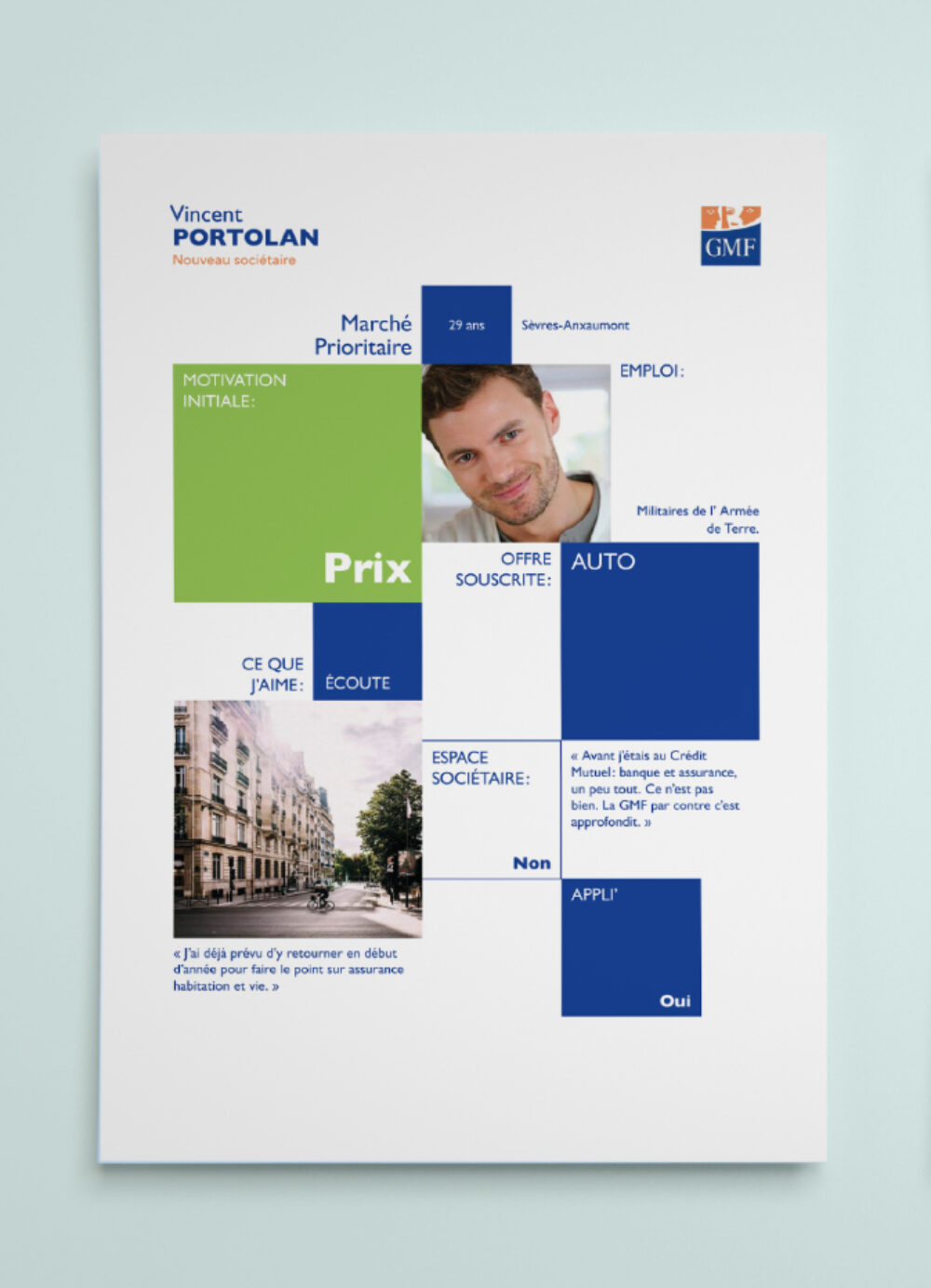

Offering a customized welcome requires solid knowledge of each client profile. Through our research and analysis, we were able to develop a new client segmentation based on new criteria, making it possible to customize the content provided at a later stage. We developed a KYC (“Know Your Customer”) module, allowing us to better understand each new client, and their needs and expectations. This information then allowed us to offer content tailored to their profile during the welcome sequence.

An extensive transformation

of internal processes.

To create a consistent multi-channel experience for clients.

A transformation of the standardized welcome sequence for each division:

For the branch representatives, we came up with an adapted version of the script used at a branch or on the phone.

For the marketing teams, we redesigned the entire welcome pack.

For the teams managing the back office, we revamped various processes.

For the data teams, we designed the KYC module.

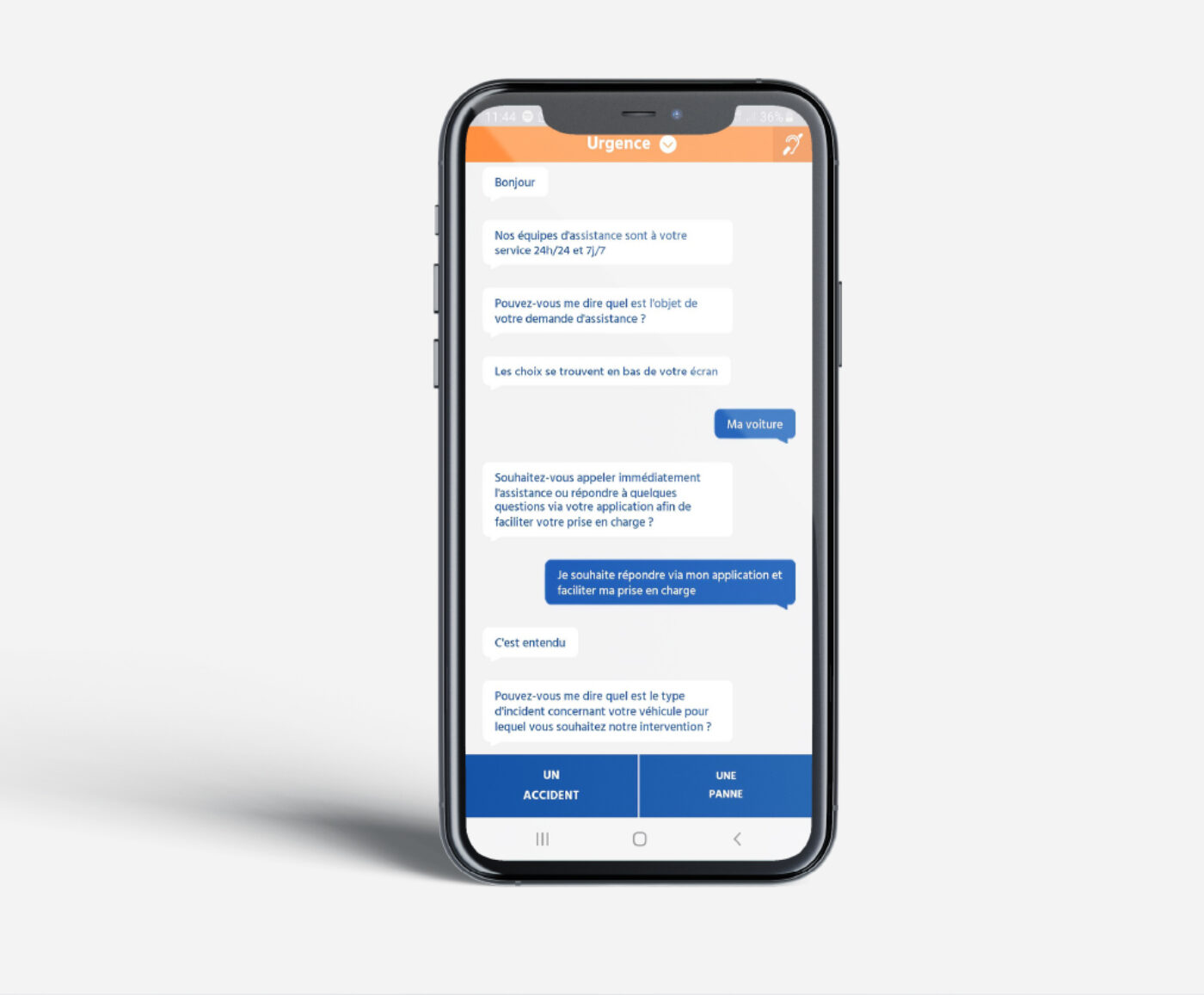

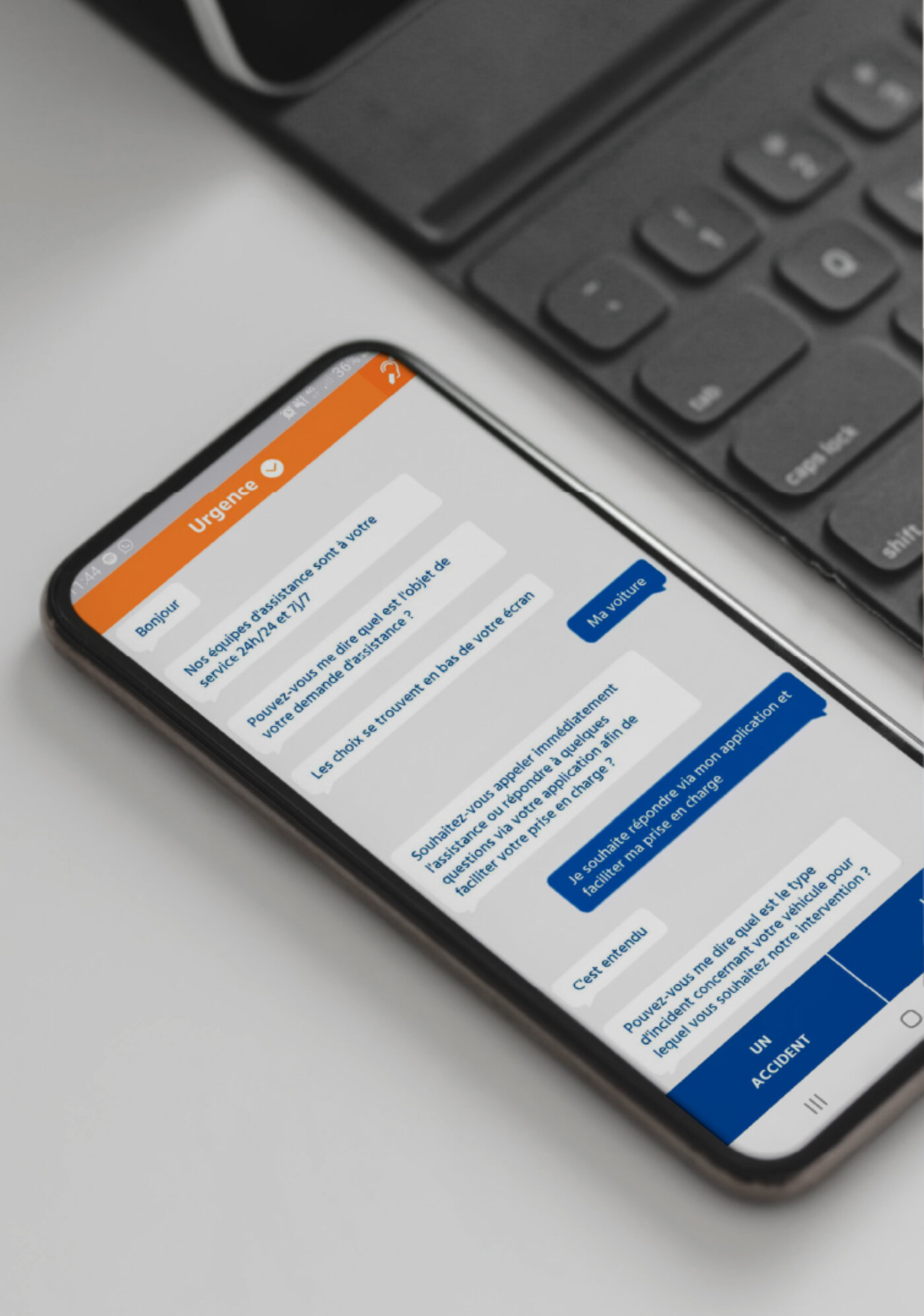

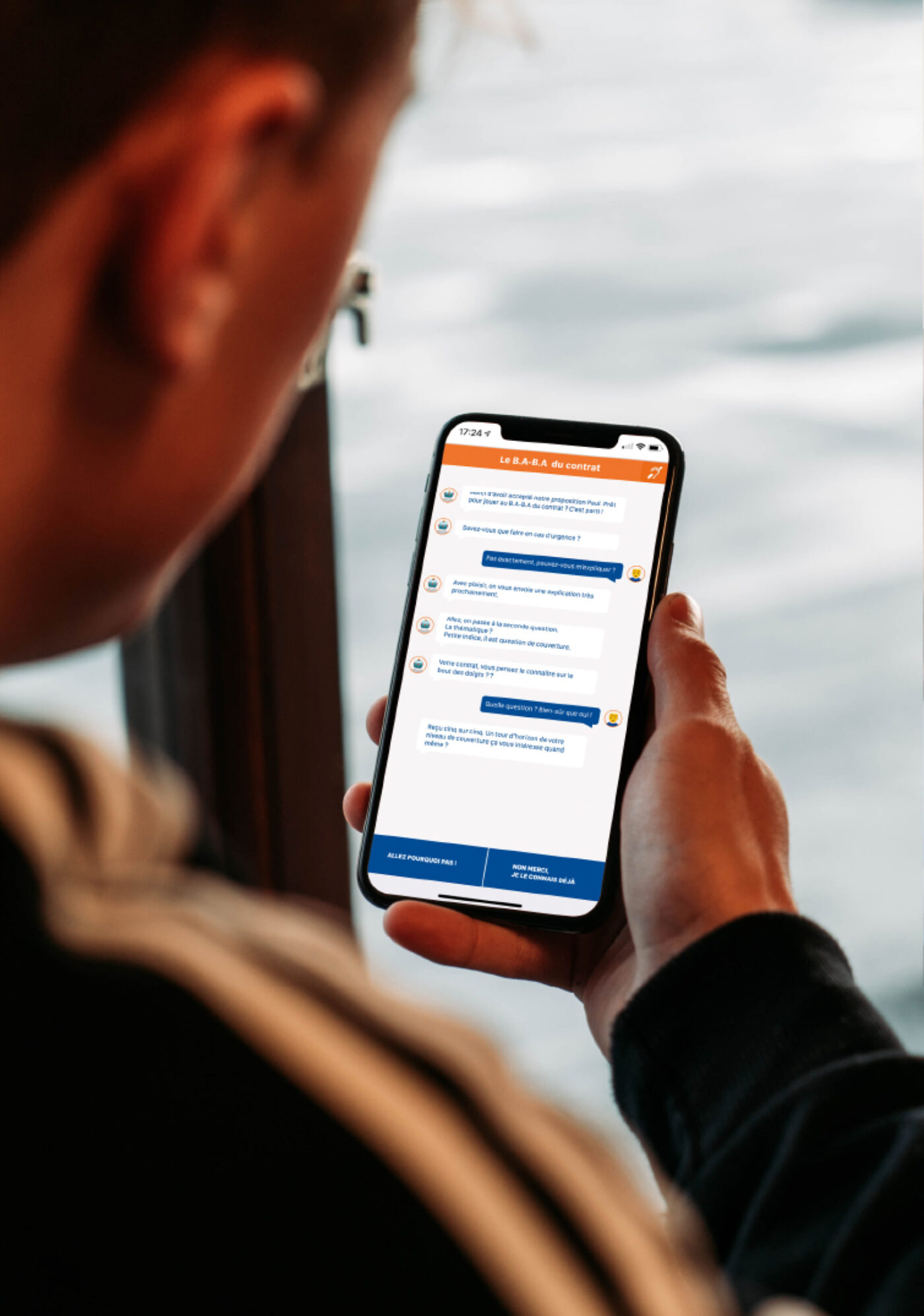

And for the digital teams, we adapted the interfaces and contents of customer accounts and the digital app.

A customer knowledge base.

This project made it possible to build a customer knowledge base for the sales teams in branch offices as well as for the marketing teams.

The activation time for memberships was made much shorter, from 17 days to 3 days after joining.

It also had a direct impact on the rate of app downloads and the rate of client account activations. As a result, this project improved the conversion rate of digital marketing actions.

This is tangible

The activation time for memberships was made much shorter, from 17 days to 3 days after joining.